Little Known Facts About Pvm Accounting.

Little Known Facts About Pvm Accounting.

Blog Article

The Best Guide To Pvm Accounting

Table of Contents5 Easy Facts About Pvm Accounting ShownThe Ultimate Guide To Pvm AccountingPvm Accounting Can Be Fun For AnyoneNot known Facts About Pvm AccountingThe 8-Minute Rule for Pvm AccountingFacts About Pvm Accounting UncoveredExcitement About Pvm Accounting

In regards to a company's total approach, the CFO is accountable for leading the business to satisfy monetary goals. Some of these methods might include the firm being acquired or purchases going ahead. $133,448 per year or $64.16 per hour. $20m+ in yearly revenue Contractors have developing demands for office managers, controllers, bookkeepers and CFOs.

As an organization expands, accountants can liberate a lot more personnel for other business obligations. This could ultimately lead to enhanced oversight, higher precision, and far better conformity. With even more resources complying with the path of money, a specialist is far more most likely to earn money precisely and in a timely manner. As a building and construction business expands, it will certainly require the help of a full-time economic staff that's taken care of by a controller or a CFO to deal with the company's funds.

The 7-Second Trick For Pvm Accounting

While big services might have full-time monetary support groups, small-to-mid-sized organizations can work with part-time accountants, accountants, or financial advisors as needed. Was this short article handy?

As the building and construction market proceeds to thrive, companies in this field should maintain strong monetary monitoring. Reliable accounting practices can make a considerable distinction in the success and development of construction business. Let's check out five necessary audit practices tailored particularly for the building and construction sector. By implementing these practices, building companies can boost their economic security, streamline operations, and make educated decisions - construction bookkeeping.

Detailed price quotes and budget plans are the foundation of building and construction project management. They assist steer the job towards prompt and successful conclusion while securing the rate of interests of all stakeholders involved.

Little Known Questions About Pvm Accounting.

An exact estimation of products required for a task will help make sure the needed products are purchased in a prompt way and in the best amount. A misstep here can result in wastefulness or hold-ups as a result of material scarcity. For the majority of construction jobs, equipment is needed, whether it is bought or leased.

Don't forget to account for overhead expenses when approximating project expenses. Direct overhead expenses are specific to a project and might consist of momentary leasings, utilities, fencing, and water supplies.

Another variable that plays into whether a project achieves success is an accurate price quote of when the job will be finished and the relevant timeline. This quote helps guarantee that a job can be completed within the allocated time and sources. Without it, a job may lack funds before completion, creating prospective work interruptions or desertion.

The 6-Minute Rule for Pvm Accounting

Accurate task costing can assist you do the following: Recognize the success (or do not have thereof) of each task. As work costing breaks down each input into a project, you can track success separately.

By recognizing these products while the job is being completed, you prevent surprises at the end of the project and can address (and hopefully avoid) them in future projects. A WIP schedule can be finished monthly, quarterly, semi-annually, or each year, and consists of job data such as agreement worth, sets you back incurred to date, complete estimated expenses, and overall project billings.

Get This Report on Pvm Accounting

It additionally supplies a clear audit trail, which is essential for financial audits. construction bookkeeping and compliance checks. Budgeting and Projecting Tools Advanced software application supplies budgeting and projecting capacities, permitting construction firms to plan future projects more properly and handle their funds proactively. Document Monitoring Building and construction tasks entail a great deal of documentation.

Enhanced Supplier and Subcontractor Administration The software program can track and manage payments to vendors and subcontractors, ensuring prompt repayments and keeping good relationships. Tax Prep Work and Filing Accounting software program can assist in tax obligation preparation and filing, guaranteeing click to read that all relevant economic tasks are precisely reported and tax obligations are filed in a timely manner.

Getting The Pvm Accounting To Work

Our customer is an expanding growth and building firm with headquarters in Denver, Colorado. With numerous energetic construction work in Colorado, we are trying to find an Accounting Aide to join our group. We are looking for a full-time Bookkeeping Aide that will certainly be in charge of giving functional assistance to the Controller.

Receive and evaluate everyday billings, subcontracts, adjustment orders, acquisition orders, check requests, and/or other associated documents for efficiency and conformity with economic plans, treatments, spending plan, and legal needs. Update monthly analysis and prepares budget plan fad reports for building jobs.

The smart Trick of Pvm Accounting That Nobody is Discussing

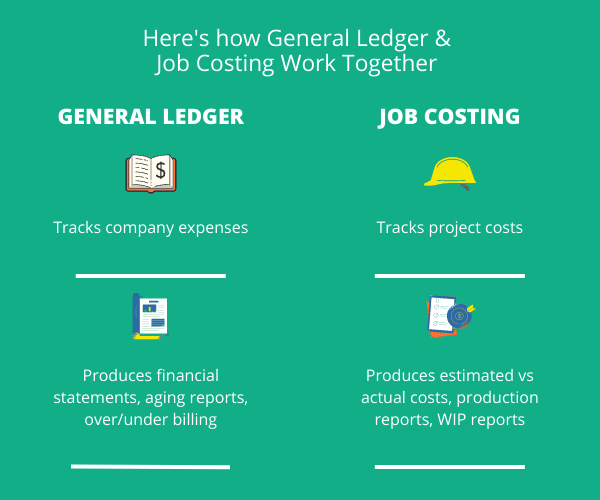

In this guide, we'll look into various aspects of construction audit, its significance, the standard devices utilized around, and its function in building and construction tasks - https://cream-marigold-kdrvzg.mystrikingly.com/blog/mastering-construction-accounting-your-ultimate-guide. From financial control and cost estimating to money circulation monitoring, explore how audit can benefit building and construction jobs of all ranges. Building accountancy describes the customized system and procedures made use of to track economic information and make strategic decisions for building organizations

Report this page